Winter, 2022

—Russell B. Dow, JD

Private Account Portfolio Manager

Let 'er Rip

A Guide to Navigating Inflation

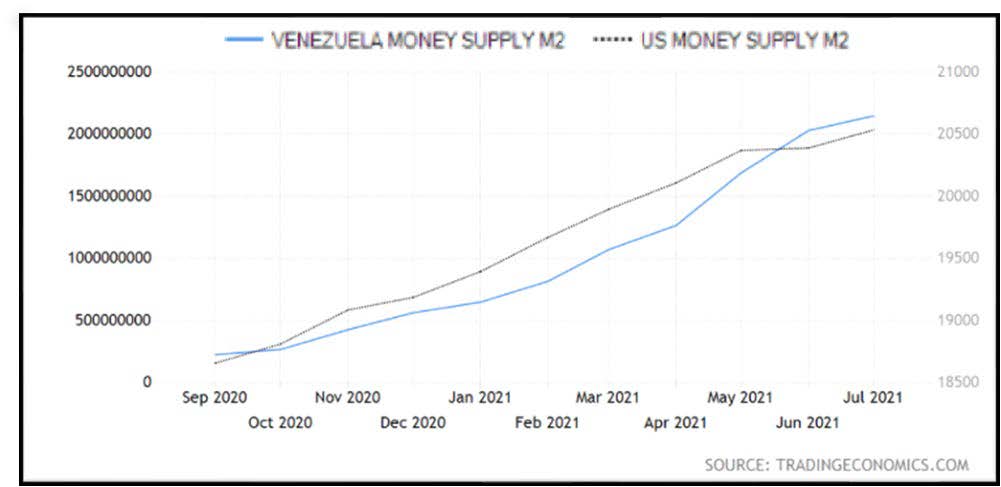

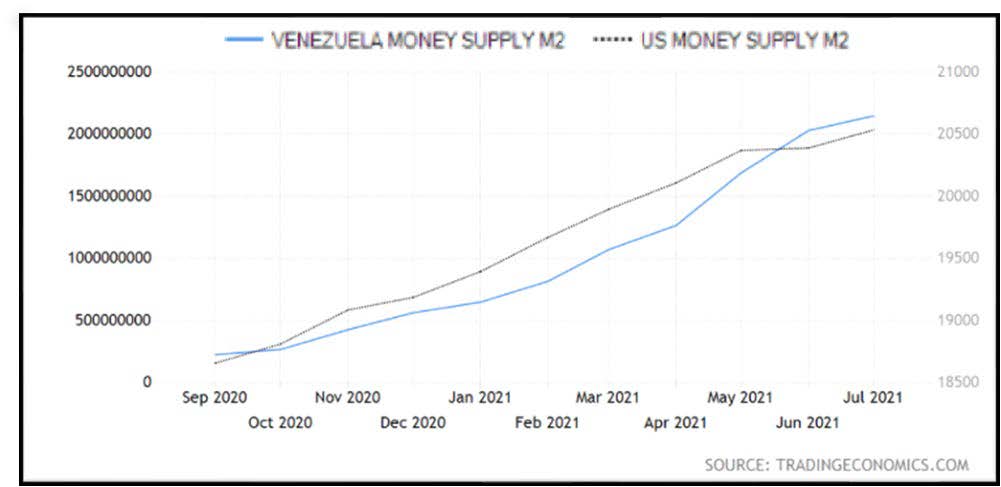

Good news from a place least expected: President Maduro has sorted out his monetary policy. The Venezuelan money supply growth rate now mirrors that of the U.S. (see the chart below).

Or, is it t’other way around? Washington’s strategy now looks like Caracas’. i

Either way, both up north and down south, the currency printers are running fast.

Writes the Wall Street Journal, “Between December 2019 and August 2021, the U.S. money supply, measured by M2, grew by $5.5 trillion, a stunning 35.7% increase in only a year and a half, driven primarily by the Fed’s purchases of Treasurys and mortgage-backed securities.” ii

This explosion of our money supply has not been without deleterious consequence. From pre-pandemic rates, inflation has nearly quadrupled from 1.8% (2019) to 6.8%, a 39-year high. Looking upriver, the Producer Price Index (the prices that companies pay) skyrocketed nearly 10% in November from its year-ago level. Those elevated costs are expected to flow down to consumers in the form of yet more price rises.

Inflation is a two-sided problem of money chasing a nation’s limited economic output. On the one hand, the Federal Reserve has swollen the money supply so that we have too many dollars doing the chasing. On the other, pandemic-induced disruptions have slowed the pace of goods reaching the marketplace for consumers to buy. That gives us two ills in need of fixing before the devaluing-dollar problem is solved.

With the trillion-dollar infrastructure spending plan now in its launch phase, low labor participation rates (the lowest since 1977), and more pandemic lockdowns underway, the trend seems apt to persist.

Impact on Investors

Inflation is a tax on wealth and income. For its recent impact on savers, it is no different than if the state reached into a $100k bank account and took $7k. Except that inflation is stealthier than a tax. The money’s still there; it just doesn’t go as far.

The dollar’s eroding purchasing power might be expected to affect various asset classes differently:

- Cash: Low-yielding cash deposits are devalued at near the rate of inflation.

- Bonds: Fixed-income instruments (e.g., bonds or bond funds, annuities, fixed pensions) incur heightened losses because the interest and principal payments can be decades away. Long maturities compound the damage.

- Stocks: Equity investors (stock investors, real estate owners) seem to have reasonable expectations of maintaining their purchasing power. Inflation causes the replacement cost of assets to rise. As well, companies push through price increases to protect their earnings, helping to keep shareholders whole.

- Indebtedness: While indebtedness is not an asset class, debtors are potential winners. A weakening dollar makes I.O.U.s easier to repay as wages rise. Long-term, fixed-rate home mortgages secured at ultra-low rates, for example, could prove to be highly beneficial for the mortgagors.

That is why, then, it has always seemed to me that inflation is an “optional” tax. How one is positioned can result in vastly different outcomes—for the better or worse.

With the stock market up +38% from its pre-pandemic high (coincidentally about the growth of the money supply?), equity owners have kept well ahead of the fray.

This Time it's Different

The 10-year U.S. Treasury yield reached 13.9% in 1981 when the inflation rate climbed to 10.3%. In other words, at that time, fixed-income investors could net an inflation-adjusted profit even during a “worst-case” period. So, like canoeists paddling hard upriver, they could still make headway.

Today, by forcing interest rates down, the Federal Reserve has taken the paddles away, leaving the canoe to be swept downriver.

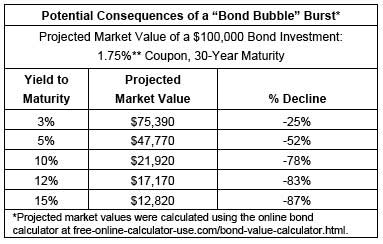

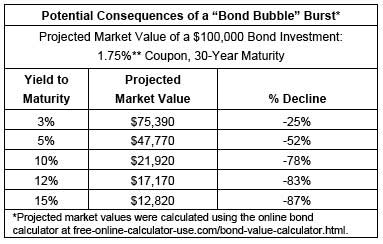

Worse yet, if there is a waterfall ahead caused by escalating rates, it could look like this:

Consequently, a period of rising rates would give a new definition to the term “junk bond” when most all obligations would look sickly.

Pressures in the bond market seem to be building with no relief valve in sight:

- The national debt, as a percentage of GDP, was just 31% in 1981. Today it stands at 123%. iii

- Government regulations require banks to hold high-quality liquid assets, so financial institutions are absorbing large quantities of the new government debt.iv That starts to wreak of “financial repression” more commonly associated with the likes of Argentina. Attempting to contain inflation is like squeezing a balloon. Short-term fixes risk causing a new problem to pop out someplace else and bursting when it does.

- The Federal Reserve is being exceedingly cautious (i.e., “slow”) in combating the problem. Even in the face of a fast-devaluing dollar, the Fed projects just a total 0.75% rate increase over all of 2022 while they continue to fuel the inflationary forces (the bond purchases are not expected to end until March). In other words, they continue to accelerate the vehicle even as it’s starting to shake. The Fed’s deferred action, then, could compel more drastic rate increases later. Bond investors might do well to contemplate and prepare for a much-evolved environment in the years ahead.

What to Do?

The erosion of purchasing power due to inflation tends to be permanent. After a period of high inflation, there is no likely avenue for recouperation for cash and bond investors. Therefore, not getting caught on the wrong side of the fence at the zoo must be the first goal.

Seeking to remain prepared for both good and bad climates, our strategy for long-term investment success seems as relevant to the times as ever:

- Own equity to help insulate a portfolio from erosion of its purchasing power caused by inflation.

- Own high-quality equities to guard against a recession that might cause weaker companies to fail. Rising interest rates this year, alone, risk pushing the economy into a downturn.

- Own equities directly so that the investor is never cornered into a 2020-style decision of jettisoning the baby with the bathwater. During the pandemic-fueled sell-off, mutual fund and ETF investors seeking to rid their portfolios of their most at-risk issues had only one button to push: Sell everything or sell nothing. That can be a poor choice during dynamic and perilous markets, forcing de facto market timing.

That strategy seeks to minimize the risk of irrecoverable loss while being willing to subject our portfolios to market volatility for the potential of long-term gains. If we have reasonable confidence that portfolio declines are likely to be temporary, then it can be easier to endure the occasional setbacks along the way.

2022 arrives with a host of concerns. Inflation, rising interest rates, a resurgent pandemic and lockdowns, China, and Russia are all able to upset economic order overnight. Whatever obstacles the New Year might bring, a portfolio that is sound at its core seems well able to navigate the challenges and prosper as our economy continues to regain its footing.

This Time It’s Not Different

The markets (and the media) cycle through an endless litany of investment fads. Just a few years ago, cannabis and artificial meat stocks were the rage. At the dawn of the modern Internet, someone explained to me that he was “investing” in domain names in the belief that there was a finite supply. Unfortunately for that early investor in virtual assets, the number of possible domain names exploded as 1500 new extensions have since been added. The scarcity was contrived and fleeting.

Today, we are rich with new headline attention-grabbers: Crypto Currencies, Non-Fungible Tokens (NFTs), SPACs, Meme Stocks, profitless EV and AI stocks.

There is a line between “investing” and “speculating” (equally characterized as “gambling”). At present, it seems especially easy to see where to draw it. There is a lot of investment rubbish being sold these days.

If one happens to be inclined for them, if a portfolio is otherwise substantial and substantially sound, then there is arguably room for a few such issues. There may be sport in that. But such investments should be seen for what they are: very-long shots, lottery tickets unlikely to work out well.

For today’s modern virtual investor, crypto currencies and NFTs are the cutting edge (or possibly bleeding edge). Bitcoin, the granddaddy of the crypto currency world, has lit the way to 10,000 competitor currencies.

Despite its woes, the U.S. dollar is still legal tender backed by the sovereignty of the U.S. government and the nation’s economic enormity. Crypto currencies can make no such claim. They come with no assurance that they can be used to pay obligations. Their utilities have none of the guarantees associated with traditional currency.

In fact, the values of crypto currencies are underpinned only by the hope that someone else will want to purchase them. They are momentum plays. People buy them only because they’ve gone up in value (“fear of missing out”) and they sell when the tide turns for fear of being the last one holding an empty bag. As currencies, many fail as efficient mediums of exchange or as reliable stores of value.

Blockchain, the technology on which many crypto currencies are built, may well be the future of money. But the coin of the realm may not yet have been minted. When it is, as has happened so many times in the past, investors chasing the next shiny object may well leave all the others behind to lose their luster.

Investment Design and the Value of "None"

From an investment perspective, the optimal allocation to an asset class is often “None.” That is counter to the “Some of Everything” approach espoused by many in constructing a portfolio.

But “None” affords a higher concentration— without distraction—to those assets most apt to provide strong long-term results.

So, for portfolio design, we adhere to the Latin:

Nil satis nisi optimum.

Nothing but the best is good enough.

That probably applies well as a guiding principle to most things in life and certainly, so, when it comes to irreplaceable investment assets. We treat them as such.

Thank you for your confidence.

I wish you the very best in this New Year.

Kind regards,

Russell B. Dow

President & Senior Portfolio Manager

Member: Maine State Bar Association

This paper represents the general economic overviews of Russell Dow, Dow Wealth Management, LLC, and does not constitute investment advice, nor should it be considered predictive of any future market performance.

The views and opinions expressed in this article do not necessarily reflect the official opinion or position of Bolton Global Capital/BGAM. The

representatives at Dow Wealth Management are not tax professionals and do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

©2022 Dow Wealth Management, LLC

Download PDF Here